- Bill fraud

What is this increasing scourge?

Invoice fraud is a constantly increasing phenomenon that affects many companies, regardless of their size and sector of activity . You are subject to it as soon as you have an accounts payable process.

Invoice fraud is when fraudulent invoices are created or altered to steal money from a business.

According to a study conducted by the Association of Financial and Management Control Directors ( DFCG ), nearly 25% of French companies have already been victims of this type of fraud . Frauds are generally as follows:

- Increase in prices or quantities

- Creation of entirely fictitious suppliers

- Redirecting payments to unauthorized accounts.

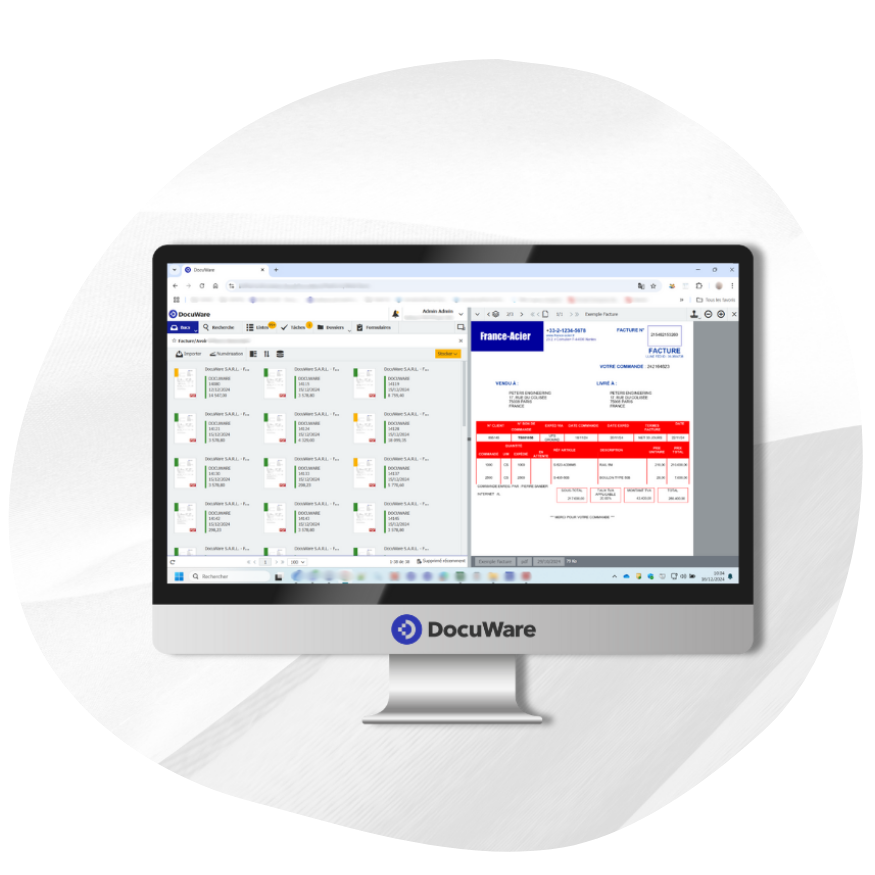

If you have not put adequate protections in place, you are exposing yourself to disastrous financial and reputational consequences. Faced with this scourge, Electronic Document Management software can considerably reduce the risk of invoice fraud. They also help protect your business by automatically detecting suspicious activity, such as duplicate or modified invoices.